Chase Sapphire Ultimate Rewards Program

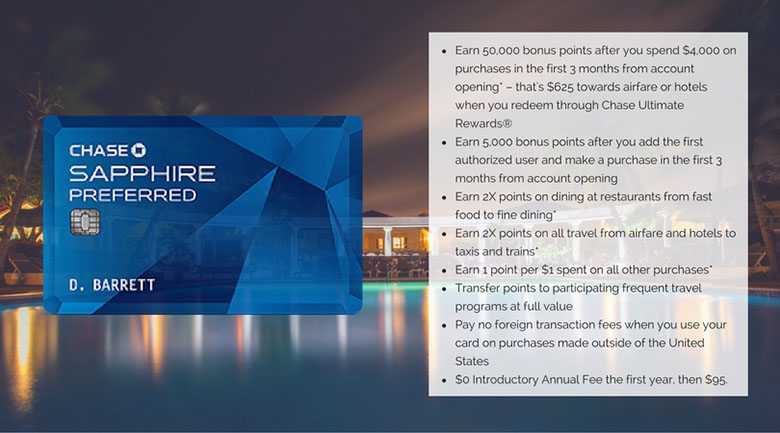

Chase Sapphire Preferred card review. The Chase Sapphire Preferred card is designed to make an impression. The Ultimate Rewards program that comes with several Chase credit cards is one of the best credit card rewards programs out there. Not only are its basic rewards. The Offer. Direct Link. Chase is sending out an email to Sapphire cardholders email subject is Get more points with every purchase Get an extra 1x Ultimate. If you dont already have the Chase Sapphire Preferred in your wallet, here are five reasons it should be your first credit card application this year. Read our review of the Chase Sapphire Preferred card to see why it offers one of the most valuable rewards programs. First off, theres the physical design of the card Chase has defied the plastic conventions of the industry and created a sleek, blue card made of honest to goodness, actual metal. The distinctive plink that it produces when you plop it into the tray to pay for dinner is sure to generate some remarks from your friends. But the value of this card runs deeper than its flashy exterior. The Sapphire card is an amalgam of great travel perks, valuable rewards and exceptionally flexible redemption options that an avid rewards card user can leverage to gain some extra value. The highest bonus in the industry. Cyber Twin Patch Editors. Right off the bat, Chase offers a sign up bonus that matches the best of the cards in the rewards category 5. Then, it tops other cards with an additional 5,0. Screen-Shot-2016-08-17-at-9.01.49-PM-1024x668.png' alt='Chase Sapphire Ultimate Rewards Program' title='Chase Sapphire Ultimate Rewards Program' />Thats 625 toward travel when you redeem through Chase Ultimate Rewards. Or transfer points to United MileagePlus, Southwest, British Airways, Marriott, and more. Chase-Sapphire-Preferred-50k-Offer.png' alt='Chase Sapphire Ultimate Rewards Program' title='Chase Sapphire Ultimate Rewards Program' /> This adds up to 5. High rewards for frequent travelers and diners. On the downside, the rewards rate is not the highest the industry has to offer. While some of our top rated cards offer double bonus points on all categories of spending, the Chase Sapphire Preferred card only offers double points on travel and dining. This makes it a valuable card for users who spend a lot of money in these categories, especially cardholders who know how to juggle points to maximize their rewards rate. Well explain how in a minute. Highly flexible rewards redemption. Chases rewards program is likely the most flexible one in existence, with options to redeem your points for travel, merchandise and cash back. Youll get a higher rewards rate by redeeming your points for travel through Chases Ultimate Rewards website, which offers a 2. But you can also purchase travel on sites outside of Chase and use the cash back option to cover the costs with statement credits. And the value of points for cash back is high at. You can transfer points at a high rate. The Chase Sapphire Preferred card also lets you transfer points to a variety of frequent flier programs at a one point per dollar rate. On top of that, you can transfer points from other Chase cards into your Chase Sapphire Preferred account. This is where a discerning rewards card user gains the advantage. For instance, if you also own a Chase Freedom card, you can use that card to get 5 points per dollar in the bonus categories, transfer them onto your Chase Sapphire Preferred card and then transfer all of those points to your frequent flier card to take advantage of a special price on a flight. Not for the casual card user. On the other hand, if you dont want to do all this extra thinking, or if you dont spend enough to justify the hefty annual fee of 9. There are other cards out there that offer a higher general rewards rate with smaller fees and simpler rewards structures. In addition to the rewards program, the card includes a large number of travel perks, including an EMV chip and no foreign transaction fees. Altogether, this makes it a great card for frequent travelers who are looking to get the most value possible out of a rewards card. Why get the Chase Sapphire Preferred card You own another Chase rewards card. You spend a substantial amount on travel or eating out. Youre a frequent traveler, who can get the most out of the bonus points and travel perks. Youre a savvy rewards card user who wants to squeeze some extra value out of your rewards. Youre a frequent customer of Chases partners, including United, Southwest, Virgin Atlantic, Hyatt and Marriott. How to use the Chase Sapphire Preferred card Stick to redeeming your points for travel youll get the highest reward rates through Chases Ultimate Rewards site and by transferring to one of Chases travel partners. Use it in tandem with Chases Freedom card to maximize your rewards you can rack up extra points through their five points per dollar bonus categories and then transfer them to your Sapphire account. If you prefer to book your travel with an outside travel site, you can use a statement credit to cover your purchases at. Our reviews and best card recommendations are based on an objective rating process and are not driven by advertising dollars. However, we do receive compensation when you click on links to products from our partners. Learn more about our advertising policy.

This adds up to 5. High rewards for frequent travelers and diners. On the downside, the rewards rate is not the highest the industry has to offer. While some of our top rated cards offer double bonus points on all categories of spending, the Chase Sapphire Preferred card only offers double points on travel and dining. This makes it a valuable card for users who spend a lot of money in these categories, especially cardholders who know how to juggle points to maximize their rewards rate. Well explain how in a minute. Highly flexible rewards redemption. Chases rewards program is likely the most flexible one in existence, with options to redeem your points for travel, merchandise and cash back. Youll get a higher rewards rate by redeeming your points for travel through Chases Ultimate Rewards website, which offers a 2. But you can also purchase travel on sites outside of Chase and use the cash back option to cover the costs with statement credits. And the value of points for cash back is high at. You can transfer points at a high rate. The Chase Sapphire Preferred card also lets you transfer points to a variety of frequent flier programs at a one point per dollar rate. On top of that, you can transfer points from other Chase cards into your Chase Sapphire Preferred account. This is where a discerning rewards card user gains the advantage. For instance, if you also own a Chase Freedom card, you can use that card to get 5 points per dollar in the bonus categories, transfer them onto your Chase Sapphire Preferred card and then transfer all of those points to your frequent flier card to take advantage of a special price on a flight. Not for the casual card user. On the other hand, if you dont want to do all this extra thinking, or if you dont spend enough to justify the hefty annual fee of 9. There are other cards out there that offer a higher general rewards rate with smaller fees and simpler rewards structures. In addition to the rewards program, the card includes a large number of travel perks, including an EMV chip and no foreign transaction fees. Altogether, this makes it a great card for frequent travelers who are looking to get the most value possible out of a rewards card. Why get the Chase Sapphire Preferred card You own another Chase rewards card. You spend a substantial amount on travel or eating out. Youre a frequent traveler, who can get the most out of the bonus points and travel perks. Youre a savvy rewards card user who wants to squeeze some extra value out of your rewards. Youre a frequent customer of Chases partners, including United, Southwest, Virgin Atlantic, Hyatt and Marriott. How to use the Chase Sapphire Preferred card Stick to redeeming your points for travel youll get the highest reward rates through Chases Ultimate Rewards site and by transferring to one of Chases travel partners. Use it in tandem with Chases Freedom card to maximize your rewards you can rack up extra points through their five points per dollar bonus categories and then transfer them to your Sapphire account. If you prefer to book your travel with an outside travel site, you can use a statement credit to cover your purchases at. Our reviews and best card recommendations are based on an objective rating process and are not driven by advertising dollars. However, we do receive compensation when you click on links to products from our partners. Learn more about our advertising policy.